Accurate mileage

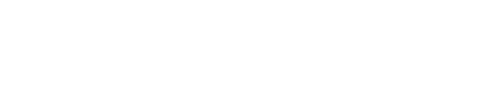

Accurate mileage tracking featuring both postcode-to-postcode lookups and street level addresses.

Capture journeys on the app, simply hit start, add any stops along the way and then finish. The journey is automatically captured and added to the claim.

Customisable mileage rules support typical home to office/location calculations along with relocation mileage and mileage threshold reduction.