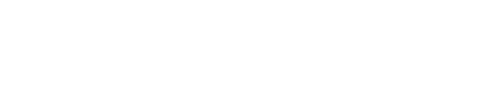

Our technology is used by over 800 organisations to engage, plan, support and deploy their people and supporting resources in the fairest and most effective way.

Week in and week out over 2 million people use our solutions to manage their working lives.

From workforce planning and scheduling to temporary staffing, communications and HR processes, we are helping organisations attract and retain staff, enabling them to better meet demand, reduce administrative burden, and support individuals day to day by offering greater flexibility and control.